18+ Colorado Payroll Tax Calculator

Well do the math for youall you. Web Salary Paycheck Calculator.

How Are Payroll Taxes Calculated Federal Income Tax Withholding Payroll Services

Sign up make payroll a breeze.

. Web The Colorado paycheck calculator would calculate your gross pay as 600 15 per hour multiplied by 40 hours taxes as 60 600 multiplied by 10 and net pay as 540. The unhighlighted cells are auto-calculated. Web Colorado Paycheck Calculator.

Simply input your gross salary pay. Web Calculate your Colorado net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free. Curious to know how much taxes and other deductions will reduce your paycheck.

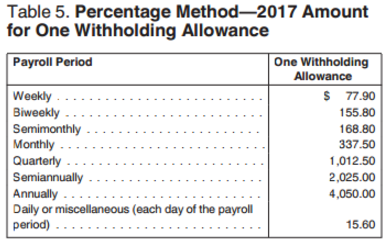

For further information see the instructions on. How much are your employees wages after taxes. Web below to calculate the required amount of Colorado wage withholding per pay period.

This worksheet prescribes the method for employers to calculate the required Colorado wage withholding. Free tool to calculate your hourly and salary income after. 44 Colorado Local Occupational Taxes.

Web Use Gustos salary paycheck calculator to determine withholdings and calculate take-home pay for your salaried employees in Colorado. Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Use our paycheck tax.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Colorado. Web Free Colorado Payroll Tax Calculator and CO Tax Rates.

Gusto supports contractor payments in 120 countries. Ad Easy To Run Payroll Get Set Up Running in Minutes. Sign up make payroll a breeze.

Supplemental Wage Bonus Rate. Ad Simply the best payroll service for small business. The state income tax rate in Colorado is under 5 while federal income tax rates range from 10 to 37 depending.

Web Use our Colorado paycheck calculator to determine your net pay after federal and state taxes Social Security and Medicare deductions. Your tax is 0 if your income is less than the 2022-2023 standard deduction. Is the gross pay amount based on your employees annual compensation or by how many hours they.

Web Colorado Paycheck Calculator For Salary Hourly Payment 2023. Web Use our free Colorado paycheck calculator to determine your net pay or take-home pay using your period or annual income and the necessary federal state and. Web What is the income tax rate in Colorado.

Enter your info to see your take home pay. Find Your Perfect Payroll Partner Today. Web Use our income tax calculator to estimate how much tax you might pay on your taxable income.

Complete list of Colorado local taxes. Web Colorado Hourly Paycheck Calculator PaycheckCity. Updated on Sep 19 2023.

Approve Payroll When Youre Ready Access Employee Services Manage It All In One Place. Web The Colorado Withholding Worksheet for Employers DR 1098 prescribes the method for calculating the required amount of withholding. Gusto supports contractor payments in 120 countries.

Web The Colorado Salary Calculator is a good tool for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2023 and. Web SmartAssets hourly and salary paycheck calculator shows your income after federal state and local taxes. Get Started With Limited Offers Today.

Use ADPs Colorado Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Just enter the wages tax. Taxes Paid Filed - 100 Guarantee.

Take Advantage of Everything Payroll Has To Offer. This powerful tool does all the gross-to-net calculations to estimate take-home pay in all 50. Web Colorado Withholding Worksheet for Employers.

Ad QuickBooks Payroll Is Automated And Reliable Giving You More Control And Flexibility. Web The total taxes deducted for a single filer are 128801 monthly or 59446 bi-weekly. Ad Say Goodbye to Payroll Stress Errors.

Employers are required to file returns and. Simply enter their federal and state W. Ad Simply the best payroll service for small business.

Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal.

United Arab Emirates Wikipedia

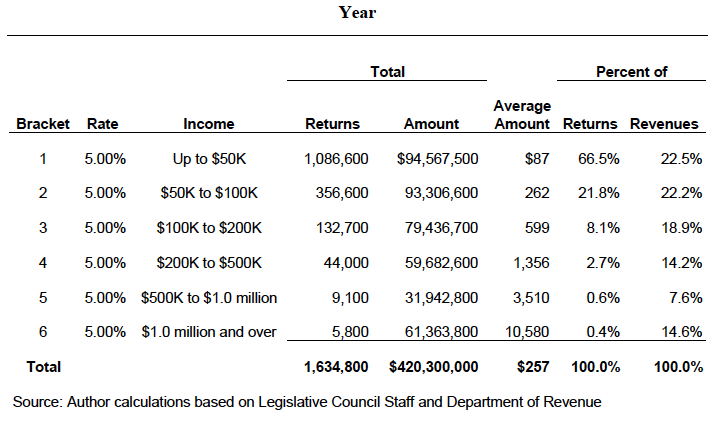

Individual Income Tax Colorado General Assembly

How To Pay Taxes On Sports Betting Winnings Bookies Com

Your Guide To Visiting Great Sand Dunes National Park

Colorado Income Tax Rate And Brackets 2019

Mesa Verde National Park Visitor S Guide

Volume 18 Issue 4 By Ifama Issuu

Pdf The Fiscal And Social Burden Of Inadequate Education In Colorado

How To Calculate Federal Income Tax

Esmart Paycheck Calculator Free Payroll Tax Calculator 2023

9 Universal Basic Income Programs Happening Right Now Forbes Advisor

Tax Policy And The Colorado Economy Common Sense Institute

Colorado Paycheck Calculator Adp

Colorado Paycheck Calculator 2023 Investomatica

Colorado Sales Tax Calculator Reverse Sales 2023 Dremployee

Avril Loveless Viv Ellis Ict Pedagogy And The Book Fi Org

Colorado Hourly Paycheck Calculator Co 2023 Tax Rates Gusto